VAT RR Invoice – What Is It All About?

The obligation to issue VAT RR invoices stems from the Value Added Tax Act (VAT). It is described in articles 115 to 118 of this act.

This is a way of refunding part of the costs to farmers (including beekeepers) that they incur when paying VAT on purchased materials. In simplified terms, it works like this: the buying point pays the beekeeper a price increased by 7%, and then the Tax Office reimburses this difference to the buying point. So, as a result, the beekeeper receives an additional 7% of the value of the agricultural products they have sold from the state budget.

The conditions are as follows:

1) You must be a lump-sum farmer (further explanation of what this means),

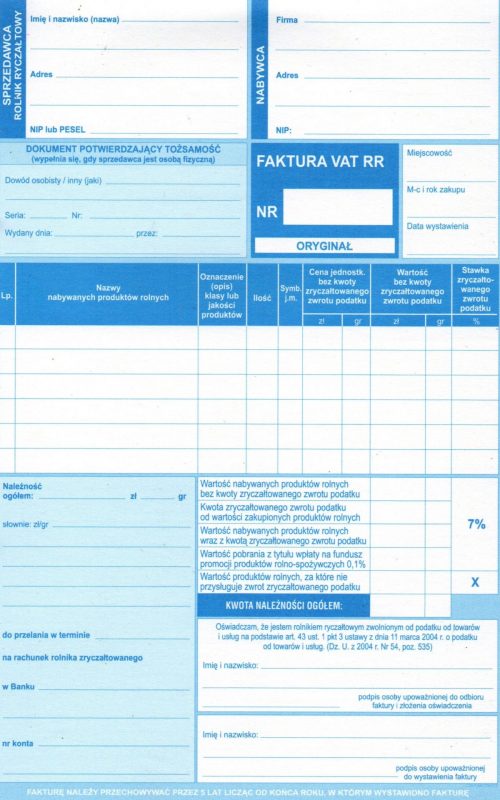

2) The buying point must issue a VAT RR Invoice (with all necessary details)

3) Payment must be made to a bank account within 14 days.

A lump-sum farmer is anyone who independently produces any agricultural products but is not a professional farmer who keeps accounting books for their farm. It doesn’t matter whether they have other income, such as a pension, retirement, or employment contract. It is quite natural to have such income because if you are not a professional farmer, you cannot sustain yourself solely from agriculture. It also does not matter whether you own agricultural land or are insured with KRUS.

Accepting a VAT RR invoice does not require the payment of any taxes. It does not need to be reported or declared anywhere. It is not entered into annual tax returns. The only obligation for the beekeeper is to keep such an invoice for 5 years.

Of course, there is the possibility of selling propolis without a VAT RR invoice and without a bank transfer. In that case, however, the seller loses the seven-percent lump-sum tax refund (at propolis prices from 2021, this is approximately 15 PLN per kilogram), and the buyer should pay a 2% tax on civil law transactions. This is much less favorable for both parties.